Climate change is an existential threat to the well‑being of our people and our planet. The interdependence of climate, biodiversity and human societies is well recognized. Climate resilient development integrates adaptation and mitigation to advance sustainable development for all. Accelerated financial support for developing countries is a key enabler to enhance climate and nature action. Supporting the private sector in developing countries can be instrumental in developing clean infrastructure, reducing energy and water use, improving the climate resilience of cities and communities, and supporting natural capital and ecosystems.

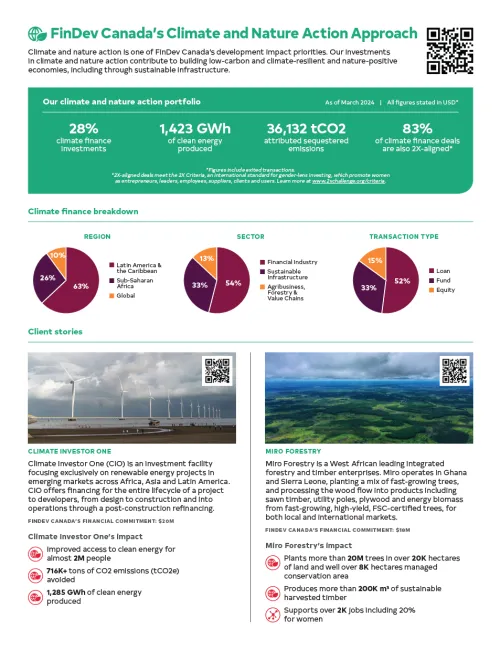

FinDev Canada supports the goals of the Paris Agreement, whose central aim is to strengthen the global response to the threat of climate change. Climate and nature action is one of our three development impact goals, along with gender equality and market development, and we apply a climate lens to all our financing and investments. All three development impact goals are critical to and informed by our mandate and serve as drivers of our decision-making. Learn more in our Development Impact Approach.

Climate change strategy

Our Climate Change Strategy, updated periodically, provides the details on our approach to climate action, underpinned by the acknowledgment that climate change is not gender neutral. We focus on climate change mitigation, as well as adaptation and resilience. Our investment strategy has intentionally focused on sectors that contribute to a climate‑resilient and low carbon economy, including renewable energy as well as sustainable agriculture and forestry.

We seek investments that can help reduce greenhouse gas (GHG) emissions and increase adaptation and resilience measures in the markets we serve, many of which are among the most vulnerable to the effects of climate change. We also recognize that climate change presents a financial risk and are committed to progressively implementing internationally recognized frameworks for climate‑related financial disclosure and assessing and managing climate risk across our investment process. Learn more in our latest climate-related disclosure.

Our Climate Change Strategy is structured around three strategic considerations:

Implementation

We are operationalizing our climate change strategy through four priorities for action, which encompass portfolio-level and institutional-level initiatives:

Nature and biodiversity

Climate change and biodiversity loss are inextricably intertwined and mutually reinforcing. Recognizing the critical need to incorporate both climate and nature considerations into our investments, we are taking the following actions to enable greater development outcomes:

- We aim to consider nature and biodiversity at different levels in our strategy, operations and decision‑making, understanding that they present both risks and opportunities.

- We leverage international best practices on managing environmental and social risks, evaluating client approaches to biodiversity conservation and sustainable management of living natural resources and requiring alignment with relevant environmental and social performance benchmarks.

- We support transactions that contribute to biodiversity protection, reforestation and preservation of the oceans.

Climate Technical Assistance

FinDev Canada engages with clients to set realistic yet ambitious climate targets and offers holistic interventions across mitigation and adaptation efforts, tailored to their business goals and priorities, which will future-proof their businesses to climate-related transition and physical risks.

As part of the portfolio level initiatives, we developed a menu of core climate action technical assistance interventions available to support our clients, including to develop their capacity to identify and manage climate change physical and transition risks, measure and reduce their GHG emissions, and embed climate change considerations into their governance, strategy, risk management and reporting.

Net-negative financed GHG emissions

FinDev Canada has built a portfolio with net-negative greenhouse gas emissions for both annual GHG emissions from our 2023 portfolio and cumulative GHG emissions since inception in 2018. In other words, since FinDev Canada’s inception, our investments and loans have contributed to more carbon removal from the atmosphere than generated GHG emissions. The three main factors supporting this are: